Quite a few traders are shocked to understand that utilizing retirement money to take a position in alternative assets has actually been doable because 1974. Nevertheless, most brokerage firms and financial institutions focus on supplying publicly traded securities, like stocks and bonds, mainly because they deficiency the infrastructure and abilities to handle privately held assets, like housing or personal fairness.

Consumer Help: Try to look for a supplier which offers dedicated help, including access to well-informed specialists who can solution questions about compliance and IRS policies.

Choice of Investment Options: Make sure the company permits the types of alternative investments you’re considering, which include real estate property, precious metals, or private fairness.

Going money from just one form of account to a different form of account, like transferring funds from a 401(k) to a standard IRA.

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the purpose of producing fraudulent investments. They often idiot buyers by telling them that When the investment is recognized by a self-directed IRA custodian, it has to be legitimate, which isn’t legitimate. Once more, Be sure to do thorough due diligence on all investments you select.

At times, the costs connected to SDIRAs could be higher plus much more challenging than with an everyday IRA. It's because on the enhanced complexity related to administering the account.

Homework: It can be identified as "self-directed" for your motive. By having an SDIRA, you will be totally chargeable for carefully exploring and vetting investments.

Including money straight to your account. Bear in mind contributions are matter to annual IRA contribution boundaries established by the IRS.

An SDIRA custodian differs simply because they have the suitable staff, skills, and ability to take care of custody of the alternative investments. The initial step in opening a self-directed IRA is to find a service provider go to website that is definitely specialized in administering accounts for alternative investments.

Regardless of whether you’re a monetary advisor, investment issuer, or other financial Experienced, examine how SDIRAs may become a powerful asset to develop your small business and obtain your Specialist aims.

Of course, real estate property is one of our customers’ most his response popular investments, in some cases termed a real estate property IRA. Clientele have the option to take a position in almost everything from rental Qualities, professional real estate property, undeveloped land, property finance loan notes plus much more.

Being an Trader, on the other hand, your options are usually not limited to shares and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Property is one of the most well-liked selections among the SDIRA holders. That’s simply because it is possible to put money into any kind of real-estate by using a self-directed IRA.

Nevertheless there are lots of Gains related to an SDIRA, it’s not with no its possess disadvantages. A number of the frequent explanations why investors don’t decide on SDIRAs involve:

When you’re seeking a ‘set and forget’ investing method, an SDIRA in all probability isn’t the ideal choice. Because you are in total control more than each investment produced, It is your choice to perform your individual homework. Try to remember, SDIRA custodians are usually not fiduciaries and cannot make recommendations about investments.

The tax benefits are what make SDIRAs interesting For most. An SDIRA may be both equally standard or Roth - the account style you select will rely mainly in your investment and tax tactic. Verify with the financial advisor or tax advisor when you’re unsure that's very best for yourself.

Schwab delivers a number of retirement strategies for compact organizations, whether or not your organization employs just one or numerous.

As opposed to stocks and bonds, alternative assets are often more challenging to offer or can have strict contracts and schedules.

A self-directed IRA is undoubtedly an very effective investment car or truck, but it’s not for everyone. Since the expressing goes: with terrific power comes excellent duty; and using an SDIRA, that couldn’t be additional legitimate. Continue reading to master why an SDIRA could possibly, or won't, be for yourself.

Opening an SDIRA can present you with access to investments Commonly unavailable through a financial institution or brokerage business. Here’s how to begin:

Michael Oliver Then & Now!

Michael Oliver Then & Now! Michael C. Maronna Then & Now!

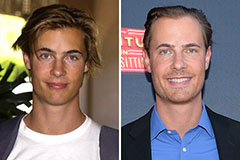

Michael C. Maronna Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!